Read more

By aligning with regulatory expectations on managing climate-related and environmental risks, Eurobank not only mitigates potential financial losses, but also enhances its competitive position. The Bank's comprehensive assessment and monitoring of sustainability risks across its portfolio requires clients to provide additional data and meet sustainability criteria, safeguarding Eurobank's market perception and business model.

The integration of sustainability considerations into risk management processes not only fulfils regulatory obligations, but also bolsters Eurobank's long-term resilience and sustainability.

Sustainability risk management processes and tools

Eurobank has incorporated sustainability risk aspects across all pillars of its Risk Management Framework. The Group has established comprehensive policies and processes to identify, assess, manage and mitigate risks. This approach is a priority to ensure alignment with the Group’s Business Strategy, and compliance with regulatory and industry developments.

Sustainability risk management in financing activities is overseen by the Board member responsible for climate-related and environmental risks, the Sustainability Management Committee, and the newly appointed Group Senior Sustainability Officer (GSSO).

Sustainability risk management in the credit process

Eurobank assesses its exposure to environmental, social and governance risk, recognising that potentially inadequate client practices could negatively affect its own operations. The Bank has established internal governance arrangements to manage these risks and evaluate client performance. Additionally, the following processes and tools support the monitoring and management of sustainability risks.

A. Incorporation of environmental and social risk factors in creditworthiness assessment

The Group prioritises identifying, assessing, managing and mitigating risks to align with its business strategy and regulatory developments. Eurobank aims to foster a holistic understanding of sustainability risks and support its commitment to environmental and social responsibility. To embed this commitment into its operating model, Eurobank has implemented a range of tools to identify, measure and manage sustainability risks, which are integrated into the credit granting and monitoring processes. These tools are used by various units across the Group, ensuring that relevant tasks are carried out collaboratively and efficiently.

B. Collateral insurance requirements

At the time of loan origination, the Bank requires that borrowers provide insurance policies for real estate properties used as collateral, with the exemption of land plots. Compulsory coverage includes protection against physical risks such as fire and earthquake for all borrowers. In 2024, flood insurance also became mandatory for retail borrowers. Additional insurance requirements vary based on the type of property and its circumstances, such as properties under construction or near protected areas. The Bank acknowledges that physical risks, such as increased flood risks, can impact the value of collateral. Consequently, it has updated its Collateral Valuation Policy to incorporate climate-related risks, aiming to mitigate risks associated with properties vulnerable to environmental hazards, in alignment with the regulatory standards.

Through the processes described above, the Group monitors its performance on sustainability through the metrics and indicators demonstrating the sustainability risk level of its counterparties.

The key metrics for 2024 are:

- €24.9 billion loan exposures to high transition risk sectors

- €1.4 billion bond and share exposure to sectors contributing to climate change

- €31 million exposure to the top 20 most carbon-intensive counterparties

These tools aim to enhance sustainability risk awareness, support sustainable financing, and ensure compliance with Eurobank's risk appetite and credit policies.

1 The Bank incorporates comprehensive ESG due diligence triggers and risk escalation processes within its ESG Risk Assessment Framework. This process mandates due diligence for high-risk borrowers, while medium-risk borrowers also qualify for an ESG Due Diligence Report. The Bank provides recommendations for appropriate mitigating actions, and obligors are expected to submit an ESG action plan within 12 months to address identified risks and opportunities.

For further information, refer to the Sustainability Statement.

Sustainability risk management at international subsidiaries

| Integration of sustainability in risk management | ||

|---|---|---|

| Bulgaria | ||

|

Actions:

Performance:

Targets:

|

||

| Cyprus | ||

| Hellenic Bank | Eurobank Cyprus | |

|

Actions:

Performance:

Targets*:

|

Actions:

Performance:

Targets*:

|

|

| Luxembourg | ||

|

Actions:

Performance:

Targets:

|

||

* Established targets for Eurobank Cyprus and Hellenic Bank are subject to re-evaluation and redefinition due to their 2025 merger.

For further information, refer to the Sustainability Statement.

Sustainable finance, services and portfolio green transition

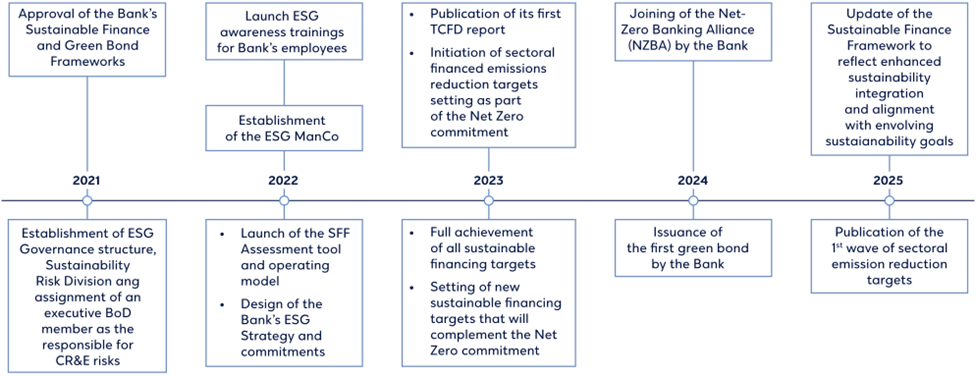

One of the Bank’s key ambitions is to become a frontrunner in supporting the low-carbon transition. To this end, Eurobank Holdings has joined the Net-Zero Banking Alliance (NZBA), reinforcing its commitment to climate change action. The aim is to align its lending and investment portfolios with the goal of achieving net-zero emissions by 2050 or earlier. The Bank will continue doing business with all its clients while focusing on supporting their transition efforts. Since embarking on its sustainability journey, the Bank has achieved significant milestones:Read more

Leveraging on tools, frameworks and other enablers, such as the climate risk assessment exercises, the Bank’s strategic approach is to support green transition efforts through direct financing and advisory solutions for capital raising to current and potential clientele. To this end, its approach focuses on:

- Sustainable financing and investments for corporate clients – Having a leading role in the large, prominent projects in the Greek economy, the Bank finances robust business plans, growth strategies, investment programmes and export activities in strategic sectors. It provides financing for landmark initiatives in the areas of renewable energy sources (RES), sustainable infrastructure and environmentally friendly solutions.

- Sustainable financing for individuals and businesses – The Bank currently offers a range of financing solutions for consumers and small businesses that support inclusive and sustainable growth. These include programmes such as Easi AFI SBs, which promote social and economic inclusion, employment generation and access to financing. Additionally, the Recovery and Resilience Facility (RRF) loans are available for investments that demonstrate a positive net present value and repayment capacity. Furthermore, financing programmes offered by supranational institutions, such as the EBRD, EIB and EAT, are assessed based on their purpose against the respective eligibility criteria and are classified as Sustainable Finance Framework (SFF)-aligned.

- Asset and wealth management with ESG criteria – In 2018, the Bank launched the LF FoF – ESG Focus, a mutual fund that invests in shares and bonds factoring in ESG criteria. The Fund has a diversified portfolio of equities and bonds that adopt ESG criteria. In addition to the LF FoF - ESG Focus, there is also the LF FoF Global Megatrends and the GF Greek Equities ESG Domestic Equity, which also promote environmental and/or social traits. The assets of these 3 mutual funds amounted to approximately €200 million at the end of 2024.

- Deposit solutions with ESG criteria – Since 2021, the Bank has been offering ESG Deposits to its corporate clients. The ESG Deposits is an innovative deposit solution that supports the clients’ sustainability agenda, by investing their liquidity in sustainable projects and allowing them to demonstrate their commitment towards a low carbon and sustainable environment. The amount raised from ESG Deposits, around €277.6 million until December 2024, is allocated to financings that meet the criteria set out in the Eurobank Sustainable Finance Framework.

Guiding frameworks

Committed to being transparent about its approach and to ensure that decision-making is in line with best practices in environmental protection and sustainability, Eurobank has developed 3 guiding frameworks, defining the approach and criteria for classifying its financing and investing activities as sustainable.

Sustainable Finance Framework

The Group is fully committed to being transparent about its sustainability approach. On account of this, the Sustainable Finance Framework (SFF) has been developed using recognised industry guidelines and principles from a range of industry standards, market principles and best practice. More specifically, the SFF’s core guidelines and principles, classification approach and eligibility criteria are based on the guiding frameworks of ICMA and LMA outlining the principles underpinning sustainable financing, as well as the Climate Bonds Standard and the EU Taxonomy Regulation.

Each guideline and principle update the SFF and offer clear criteria for identifying sustainable activities, thereby enhancing transparency and accountability in the Group's operations. This alignment not only supports the Group's sustainability objectives, but also fosters investor confidence and contributes to the broader goal of sustainable development.

Eurobank defines four 4 approaches in its SFF:

- Dedicated-purpose – Green/Social loans: Project-specific loans or financing instruments whose use of proceeds is 100% directed towards eligible green/social activities. The SFF defines the eligible activities (for the Wholesale and Retail portfolios) along with the applicable eligibility and exclusionary criteria that need to be fulfilled. The eligible areas and activities include energy efficiency, renewable energy, clean transportation, shipping, green buildings, pollution prevention and control, circular economy, Carbon Capture, Utilization and Storage (CCUS), green hydrogen, water and wastewater management, information and communication, climate change adaptation regarding the green activities, economic inclusion, affordable basic infrastructure, access to essential services, and affordable housing.

- General-purpose – Company business mix: Financing to companies that fulfil the eligibility green/social criteria and derive their revenue from eligible activities. Specifically, companies are eligible under the business mix category when they derive a minimum predefined percentage of their total revenue from eligible activities.

- General-purpose – Sustainability-linked loans/facilities: The second type of general-purpose lending adopted relates to sustainability-linked loans (SLL). The purpose of SLLs is to enable and accelerate the ESG transition of clients. Through SLLs, Eurobank provides ESG-related incentives to its clients, by offering products (loans, bond loans, etc.) with terms linked to ambitious and predefined sustainability performance targets (SPTs). The SPTs are specific targets that aim to improve the ESG performance of the client.

- Recovery and Resilience Facility-based approach: Activities approved through the Greek Recovery and Resilience Facility, contributing to the green pillar.

Green Bond Framework

Eurobank has developed a Green Bond Framework (GBF) to finance projects that deliver environmental benefits and support its business strategy. The GBF is aligned with global best practices and standards, including the EU Taxonomy eligibility criteria. It defines eligible assets, the use of proceeds, project evaluation and selection processes, and reporting obligations. The GBF promotes green investments while ensuring transparency and accountability.

Sustainable Investment Framework

The Bank has established a Sustainable Investment Framework (SIF) for the classification of investments as sustainable based on criteria observed in international market practices. Eurobank’s SIF outlines its sustainable investment strategies, selection process and monitoring frequency.

The SIF uses various classification approaches, including:

- Value-based exclusions and AML

- Norm-based exclusions

- Avoid harm (combination of value and norm-based exclusions)

- Sustainable bond selection (green, social, sustainability-linked)

For further details on the objectives and the criteria associated with each eligible activity of the SFF refer to the Group’s TCFD Climate - related & Environmental Risk Report 2023.

For further information, refer to the Green Bond Framework.

For further information, refer to the Sustainable Finance Framework.

Sustainable financing targets and performance

The Group has integrated its Financed Impact Strategy into its operation model and has made significant progress towards achieving its targets. Specifically, it has:

- Operationalised its SFF – The Group has developed governance structures, processes and tools that enable the identification of sustainable financing opportunities, engagement with clients on sustainable financing offerings and assessment of financings against the SFF criteria into daily operations. Key elements include the introduction of dedicated roles for guiding relationship managers, the integration of the wider process for classification and evaluation according to the SFF within the Bank’s systems, and the extension of the approach to retail business banking with co-financing programmes and tailored products.

- Enhanced its capabilities for the collection of sustainability risk data – The Group is continuously enhancing its capabilities for the collection of sustainability risk data, through the integration of additional information requirements in the credit process, as well as cooperation with third-party data providers. It has implemented a set of tools for identifying, measuring and managing sustainability risks, including throughout the credit granting and monitoring processes. These are used by the Units involved across the Group’s 1st and 2nd Lines of Defence, with the relevant tasks being performed in a collaborative and efficient manner. Having already performed an assessment of sustainability data availability in its internal systems against regulatory requirements/expectations, the Group continues to enhance its sustainability risk data aggregation capabilities and IT infrastructure accordingly, while also using appropriate controls and safeguards to ensure the accuracy and completeness of the compiled information. The Group seeks to further improve sustainability risk data granularity, by allocating detailed roles and responsibilities for the purposes of sustainability data management, and by addressing identified data needs (i.e. engagement with external data providers, development of methodological approaches for the estimation of required information).

- Intensified engagement with its counterparties on sustainability risk mitigation – Aiming to facilitate the transition of its clients towards a sustainable business model, the Group has developed a dedicated approach to increase client engagement and awareness regarding sustainability risks. Besides the initiatives launched aiming to build sustainability literacy and capacity among its clients (e.g. online events, articles and webinars, digital academy for businesses), the Group also uses tools to engage with its counterparties in the context of its credit granting and asset management activities, so as to understand their strategies and mitigate their sustainability risk exposures.

- Expanded its sustainable offerings – As part of the periodic revision of its SFF, the Group introduced new activities that contribute to sustainable objectives through the inclusion of emerging technologies as well as national and sectoral investment plans. Additionally, it leverages all available co-financing programmes with sustainability objectives to promote the green transition of its entire client base.

- Launched the first wave of its sectoral Net-Zero targets and developed its sectoral transition plan – As part of its Net-Zero Banking Alliance commitment, the Group has launched its 1st wave of sectoral emission reduction targets for its 4 priority sectors: power generation, oil and gas, iron and steel, and cement. The targets follow sectoral decarbonisation pathways in line with 1.5oC and have been developed based on the Group’s portfolio, outlook and business plan until 2030, also accounting for various decarbonisation levels, such as national and client-specific targets and investment plans. These targets reflect the Group’s approach towards financing the green transition of each sector by enabling the adoption of low-carbon technologies and green business models. The Group is also in the process of finalising its target and transition plan for the CRE sector, which is expected to be submitted along with the other 4 sectors in the 1st target-setting submission to the NZBA. The Bank will monitor progress and provide annual updates to ensure transparency and accountability in achieving these ambitious targets.

- Achieved the sustainable financing targets set as part of its Financed Impact Strategy – For the third consecutive year, Eurobank achieved the sustainable financing targets related to its corporate portfolio, set as part of its Financed Impact Strategy. New SFF-aligned annual disbursements exceeded the 20% target of total corporate disbursements, while corporate sustainable exposures increased from €2.18 billion in 2023 to €2.98 billion in 2024, posting a 37% year-on-year growth.

| Portfolio Targets | 2024 Performance |

|---|---|

| €2 billion in new green disbursements to businesses by 2025 | > €2 billion in new green stock as of 2024 – Target achieved |

| 20% of the annual new corporate disbursements to be classified as green | c. 21% - Annual target achieved |

| 20% stock of green exposures by 2027 for the corporate portfolio | c. 16% - On track to achieve target |

| Mobilise €2.25 billion total green RRF funds in the Greek economy by 2026 |

c. € 2.1 billion - On track to achieve target |

| No new investments in fixed income securities (excluding exposures in Sustainability/Green Bonds towards the top 20 most carbon-intensive corporates worldwide |

0 new exposures – Target maintained |

| Double annual disbursements of sustainability-linked loans |

c. € 0.7 billion in SLL, disbursements, double in relation to 2023 – Annual target achieved |

| Sectoral Targets | 2024 Performance |

|---|---|

| 35% of new disbursements in the energy sector to be directed to RES financing | > 60% of sectoral disbursements towards RES – Annual target achieved |

| 80% of disbursements related to the construction of new buildings to be allocated to green buildings | 100% of disbursements to construction of green buildings – Annual target achieved |

Sustainable financing performance

The corporate portfolio of Eurobank, which is the Group’s primary driver for sustainable stock exposures, amounts to €2.98 billion, demonstrating a 37% year-on-year growth, in line with the Group’s green stock targets, while annual disbursements have reached the respective annual target.

Total outstanding balance of sustainable exposures

In terms of allocation per financing approach, as described in the SFF, the majority of exposures relate to green / dedicated-purpose financings, while sustainability-linked and business mix financings account for the remaining 36.4%.

As per the activities financed, over half of the sustainable exposures relate to renewable energy projects, since the Bank has financed many major RES projects in the country, which aim to support the green transition of the Greek economy. Energy efficiency projects account for 6% and green buildings account for 8%. Pollution prevention and circular economy activities are still a minor part of the sustainable financing allocation.

Corporate Banking disbursements within 2024

As at year-end 2024, Corporate Banking disbursements totalled €1,273 million, comprising €537 million in dedicated-purpose financings and €736 million in general-purpose financings.

In relation to the Retail portfolio, which involves financing to small businesses and individuals, the balance as at the end of 2024 stood at €182 million, while €100 million were disbursed within 2024.

| Retail Banking | Outstanding balance as at 31.12.2024 (million €) | Disbursed amounts within 2024 (million €) |

|---|---|---|

| Green mortgage loans | 105 |

72 |

| Energy renovation loans | 26 |

8 |

| Bridge Financing – Exoikonomo | - | - |

| Electric vehicle loans |

5 | 2 |

| Photovoltaic loans to small businesses and individuals |

38 | 12 |

| Net metering |

1 | - |

| Other dedicated purpose sustainable loans to small businesses |

7 | 5 |

| Total sustainable financing |

182 | 100 |

Regarding bond positions, as at 31.12.2024 the Group held over €1.05 billion in green and sustainability-linked bonds, showcasing a 123% increase in relation to 2023. Recognising its efforts in promoting sustainable finance, the internationally renowned Global Finance magazine awarded the prestigious Best Bank for Sustainable Finance in Greece 2024 distinction to the Bank for the second consecutive year. This distinction ranks it among the best performing banks in sustainable financing worldwide and underlines the Bank’s commitment to ESG best practices, by focusing on sustainable financing initiatives designed to mitigate the impact of climate change and shape a sustainable future for everyone. This important recognition takes on particular significance as the demand for sustainable investments accelerates internationally. In this context, Eurobank has performed remarkably, reinforcing its strong and reliable presence in the market.

Green Bond Issuance

In September 2024, Eurobank issued its inaugural €850 million Green Senior Preferred Notes, marking a significant step in its sustainability agenda. The transaction attracted exceptionally strong demand, with an oversubscription of more than 5.4 times, and broad participation from international and ESG-focused investors. The proceeds will support the Bank’s green financing strategy, in alignment with its commitment to achieving net-zero emissions by 2050.

2024 Key Projects

Committed to its sustainable financing targets, the Bank participated in offering financing and advisory services on landmark projects and transactions within 2024, contributing to the sustainable development and green transition of its clients, such as:

Implementation of the EU Taxonomy Regulation

The EU Taxonomy Regulation (2020/852) defines environmentally sustainable activities to help achieve climate neutrality under the Paris Agreement. Financial and non-financial entities under the Non-Financial Reporting Directive (NFRD) must disclose their alignment.

A key metric is the Green Asset Ratio (GAR), required as of 2024, measuring the proportion of taxonomy-aligned assets. Activities must meet taxonomy criteria and ensure Do No Significant Harm (MSS).

The Group integrates taxonomy requirements through:

- Engaging clients on sustainability/climate risk.

- Monitoring KPIs for climate risk and sustainable finance targets.

- Developing disclosures to ensure compliance.

To increase taxonomy–aligned assets, the Group focuses on:

- Emission-reduction pathways aligned with science-based targets

- Sectoral and counterparty analysis for GAR optimisation

- Embedding sustainability in business planning

Results

The Group’s total GAR based on turnover and total GAR based on CapEx as at year-end 2024 cover the six climate-related EU environmental objectives and are presented in the summary below:

| Summary EU Taxonomy KPIs 2024 | ||||

|---|---|---|---|---|

| Million € | Gross carrying amount |

Turnover KPIs |

Capex KPIs | |

| Taxonomy-eligible assets |

17,868 |

24.6% | 19,408 26.7% |

|

| Taxonomy-aligned assets |

1,908 | 2.6% |

2,658 3.7% | |

| Assets |

||||

| GAR-covered assets in both numerator and denominator |

29,506 | |||

| Assets excluded from the numerator for GAR calculation (covered in the denominator) |

43,257 | |||

| Total GAR assets |

72,762 | |||

| Total assets |

101,150 |

|||

| 2023 – 2024 Taxonomy KPIs comparison | ||||

|---|---|---|---|---|

| Turnover KPIs |

Capex KPIs |

|||

| 2023 | 2024 | 2023 |

2024 | |

| Taxonomy-eligible assets |

20.9% | 24.6% | 24% | 26.7% |

| Taxonomy-aligned assets |

2.5% |

2.6% | 3.5% |

3.7% |

In 2024 taxonomy-eligible turnover increased to 24.6% and CapEx to 26.7% from 20.9% and 24% in 2023. Aligned turnover and CapEx saw slight increases, from 2.5% to 2.6% and 3.5% to 3.7%, reflecting the Group’s commitment towards sustainable financing and supporting client green transition. The reported main and additional KPIs calculated on 31.12.2024 for the Group, including the reporting templates as set out in the EU Taxonomy Regulation, EU Taxonomy Regulation Delegated Act and the European Commission FAQs, are presented in the Annual Financial Report.

For further information, refer to the Sustainability Statement.Financed emissions and the Net-Zero pathway

The Bank has committed to align its portfolio with climate transition pathways and to develop phased, sectoral decarbonisation targets covering its portfolio, with the ultimate objective of reaching Net Zero by 2050. To this end, it has developed sectoral emission reduction targets supported by appropriate transition plans and will gradually expand those targets to all material sectors of its portfolio. A key part of this process is the ongoing monitoring of the financed emissions related with its lending and investing activities.

The Bank calculates and discloses its financed emissions following the Partnership for Carbon Accounting Financials (PCAF) methodology, which is based on a revenue-based approach, with emission factors estimated for each sector and country through a multiregional input-output analysis framework. Note that where available, and with emphasis on the sectors/counterparties on which emission reduction targets are set upon, the Group aims to utilise the most credible sources available, i.e. emission data obtained directly from client disclosures. Also note that reported emissions have been applied where the disclosed emissions from the Bank’ clients have been available across Scope 1, 2 and 3, while where one or more reported scope categories were not disclosed/complete, the Bank has incorporated estimated emissions according to its internal methodology, in line with the PCAF standard.

The table below presents the breakdown of the Group’s total financed emissions between lending and investment activities:

| Emission covered exposure (million €) | Scope 1&2 (ktCO2e) |

Scope 3 (ktCO2e) |

Total emissions (ktCO2e) |

|

|---|---|---|---|---|

| Lending | 40,938 |

6,799 |

16,567 |

23,367 |

| Corporate | 29,364 | 6,440 |

16,567 |

23,007 |

| Retail | 11,574 | 359 |

- |

359 |

| Investments |

23,155 |

2,647 |

2,470 |

5,117 |

| Total | 64,093 |

9,446 |

19,037 |

28,483 |

The majority of the Group’s financed emissions come from its corporate portfolio lending, accounting for around 81% of the total, while Scope 3 financed emissions account for around 87% of the Group’s total emissions.

Furthermore, the table below breaks down financed emissions per sector of the corporate portfolio.

| NACE Code | Emission covered exposure (million €) | Scope 1&2 (ktCO2e) | Scope 3 (ktCO2e) |

Total emissions (ktCO2e) |

|---|---|---|---|---|

| A – Agriculture | 371 |

388 |

359 |

747 |

| C – Manufacturing | 4,446 |

1,975 |

10,140 |

12,115 |

| D – Energy |

2,800 |

1,200 |

216 |

1,416 |

| F – Construction |

1,065 |

63 | 694 |

757 |

| G – Wholesale and retail trade |

4,727 |

1,262 |

3,104 |

4,366 |

| H – Transporting and storage |

5,645 |

1,041 |

1,155 |

2,196 |

| I – Accommodation |

2,915 |

102 |

362 |

464 |

| Other sectors |

7,396 |

409 |

537 |

946 |

| Total |

29,364 |

6,440 |

16,567 |

23,007 |

Regarding the corporate portfolio, lending to the manufacturing sector has the biggest contribution, around 53%, followed by wholesale and retail trade, around 19%, and transportation, around 9%.

The pathway to net zero

Eurobank’s commitment to sustainability is at the heart of its strategic vision. Aligning with global climate goals and addressing the urgent need to tackle climate change, it has committed to aligning the Group’s portfolio emissions with 1.5oC climate transition pathways. It has developed phased, sectoral decarbonisation targets for the Group’s portfolio, aiming to achieve Net Zero by 2050. These ambitious commitments demonstrate its dedication to supporting the low-carbon economy transition, ensuring its financial practices are responsible and forward-thinking. The goal is to foster sustainable growth and contribute positively to communities, reinforcing its role as a leading financial institution that prioritises environmental stewardship and sustainable development.

As a proud member of the Net-Zero Banking Alliance (NZBA), Eurobank is dedicated to aligning its operations and strategies with the collective goal of achieving Net Zero emissions by 2050. This section outlines the net-zero targets for 2030, developed in accordance with the guidelines of the NZBA. These targets focus on the most carbon-intensive and influential sectors in its portfolio, underscoring its commitment to a transition aligned with the ambition of limiting global warming to 1.5oC by 2050. Its sector-specific approach to target-setting considers the unique challenges and opportunities of the climate transition, in conjunction with the Group’s business strategy, and adheres to globally recognised standards, such as those from the Partnership for Carbon Accounting Financials (PCAF) and science-based decarbonisation pathways.

This section provides an in-depth overview of Eurobank’s structured approach to defining, substantiating and disclosing its sectoral emission reduction targets. The targets include lending exposure, corporate bonds and listed equities at a Group level. The methodology is underpinned by a robust framework that draws upon national, sectoral, and client-specific investment plans and targets, in conjunction with the Group’s business strategy, guiding the target-setting process. Critical component of the process is also accounting for the effect that changes in sectoral exposure (and thus the attribution factor) might have in sectoral emissions, especially in sectors such as the Oil and Gas where these parameters significantly influence performance on the target metric.

Based on this framework, it is setting the first wave of its emission reduction and net-zero targets for its 4 most significant carbon-intensive sectors:

- Power Generation

- Oil & Gas

- Cement

- Iron and Steel

These sectors are crucial, as they represent a substantial portion of Eurobank’s financed emissions. By concentrating its efforts on these sectors, it aims to drive meaningful progress towards its overall sustainability objectives. The commitment to setting and achieving these targets reflects its strategic vision and its proactive stance in facilitating the transition to a low-carbon, sustainable and resilient economy. To this end, it is developing transition plans specific for each sector, outlining planned actions and milestones to achieve these targets.

The International Energy Agency's Net Zero Emissions (IEA NZE) scenario was chosen as the reference transition pathway to 2050 for the selected sectors. The IEA NZE scenario is widely regarded as one of the most comprehensive and scientifically robust frameworks for achieving net-zero emissions globally. It outlines a clear and actionable roadmap, emphasising the significant role that the selected sectors must play in reducing greenhouse gas (GHG) emissions.

Following the disclosure of its initial 2030 targets, Eurobank will focus on monitoring its progress and providing annual updates. In addition, apart from the 2030 targets, this report presents its 2024 progress in relation to the base year. Moving forward towards its net-zero journey, Eurobank will gradually expand its targets to additional sectors, increasing its portfolio coverage.

The following table presents key information regarding the emission reduction targets for the first 4 carbon-intensive sectors:

| Sector | Boundaries | Scopes covered | Target Metric |

Scenario/ Pathway |

Eurobank’s emission reduction targets |

||||

|---|---|---|---|---|---|---|---|---|---|

| Base year | Baseline value |

2030 target | 2030 reduction | 2024 value |

|||||

| Power generation | Fossil and RES electricity generators |

1,2 |

Intensity kg CO2e/MWh |

IEA NZE 2050 (2023 Update) |

2023 |

244 | 220 | -10% | 193 (-22% vs baseline) |

| Oil & gas | Mid / Downstream activities |

1,2 |

Absolute tCO2e |

IEA NZE 2050 (2023 Update) |

2024 |

558 (100 indexed) |

530 (95 indexed) |

-5% | n/a |

| Iron and steel |

Up / Mid / Downstream manufacturers |

1,2 | Intensity tCO2e / t steel |

IEA Net Zero by 2050 (2021) |

2023 |

0.37 | 0.33 | -10% | 0.42 (+14% vs baseline) |

| Cement |

Cement and concrete manufacturers |

1,2 | Intensity tCO2e / t cement |

IEA NZE 2050 (2023 Update) |

2023 | 0.67 | 0.59 | -12% | 0.66 (-1% vs baseline) |

Power generation

Methodological approach

Boundary

The scope of this sector includes counterparties operating in the power generation sector and, more specifically, clients with power generation activities from fossil fuels (lignite, oil, natural gas) and renewable energy (soler, wind, hydro etc.).

The sectoral perimeter excludes companies operating downstream the power generation value chain (transmission, distribution and trade).

Emissions coverage

The target covers Scope 1 and 2 GHG emissions, which account for the vast majority of the power generation footprint.

Decarbonisation scenario

Eurobank's emission reduction target for the power generation sector draws upon the trajectory outlined in the IEA NZE scenario, aiming for substantial reductions in carbon emissions and the promotion of sustainable energy practices. The power generation sector plays a crucial role in global efforts to mitigate climate change, accounting for a significant portion of GHG emissions. By adopting the IEA NZE scenario as the reference transition pathway for the power generation sector, Eurobank aims to support the rapid deployment of renewable energy sources (RES), such as wind, solar and hydroelectric power, while also supporting the stability of the energy transition through less carbon intensive energy generation technologies. Additionally, its target focuses on reducing emissions from fossil fuel-based power generation through investments in energy efficiency measures, grid modernisation and the integration of clean technologies.

For this target, Eurobank has also considered the national plan to decarbonise the sector, which can be found both in the Greek National Energy and Climate Plan (NECP) and the National Climate Law. NECP sets an 82% target for the share of RES in the total domestic electricity production by 2030, through increasing RES generation to 23.5 GW by 2030 (i.e. around a 150% increase from 2021). The rapid increase in the level of RES penetration requires the development of different types of RES and reliable energy storage solutions. To this end, NECP foresees the increase of onshore wind capacity by 65%, solar by 212% and pumped storage by 214%. It also includes the development of new technologies, such as offshore wind (1.9 GW by 2030) and battery energy storage systems (3.1 GW by 2030). The Climate Law forbids electricity generation from solid fossil fuels by 2028.

Eurobank’s sectoral approach

Eurobank recognises that a fully decarbonised power generation sector is the essential foundation of a net-zero energy system, which will also play a key role to leading decarbonisation across all sectors, from transport and buildings to industry. Electricity generation will need to reach net-zero emissions globally in 2040 and be well on its way to supplying almost half of total energy consumption. This will require huge increases in electricity system flexibility, investments in new services and technologies such as batteries, demand response and green hydrogen, while renewable energy technologies remain the key to reducing sectoral emissions. A more electrified, renewables-based and efficient energy system brings clear environmental benefits as well as important gains for affordability.

Eurobank’s current financed emission intensity baseline sits below the sectoral pathway, at 244 kgCO2e/MWh, mainly due to the significant share of financed RES production output in relation to fossil fuel-based production. Drawing from sources such as national and client-specific investment plans, as well as the Group’s sectoral business plan, the Group has set the target to reduce the sectoral financed emission intensity by 10% by 2030, which is above the respective pathway reference value.

This target is based on prudent projections about the timing and emission reduction effect of the key sectoral decarbonisation levers, decommissioning of lignite and oil plants, emission reduction investments of key counterparties as well as the Group’s additional financing in renewable energy projects. Recognising that a key element in the sectoral transition is safeguarding the stability of the energy supply, the Group will also finance projects in lower emitting power generation technologies, such as Combined Cycle Gas Turbine (CCGT) power plants, in Greece and abroad. While CCGT plants will add to the Group’s overall emission profile in the short-term, they are considered a critical component of the energy transition, providing the necessary flexibility and reliability to support the integration of intermittent RES, and ensuring energy security during the transition period. Their role is especially important in maintaining grid stability as legacy high-emission assets are phased out. Looking beyond 2030, the Group is committed to aligning with more ambitious decarbonisation trajectories, potentially exceeding the reference values of the pathway, reflecting its long-term vision for a sustainable and resilient energy system.

In 2024, the Group’s sectoral performance demonstrated a significant decrease, -22% in relation to the 2023 baseline, mainly driven by emission reductions demonstrated by the key national energy producers, in line with the national plans.

In response to the above and to reach its sectoral emission reduction target, Eurobank plans to further mobilise its strategy to finance the upgrade of energy transmission and distribution systems, and promote innovative energy saving and storage technologies, in line with the NECP and its ambitious energy efficiency targets by 2030. Eurobank’s commitment in supporting the increase in renewable energy share in the total energy mix has been evident, with substantial year-on-year increase in RES project financing and an outstanding balance of over €1.43 billion at the end of 2024. It will intensify even further its financing towards RES projects, conventional as well as emerging technologies, contributing to the increase in RES share in the total energy mix and the country’s lignite phase out plan.

Oil and Gas

Methodological approach

Boundary

The target-setting focuses on counterparties engaged in:

- Midstream activities – Transportation, storage and liquefaction of oil, natural gas or LNG.

- Downstream activities – Refining activity.

Eurobank’s portfolio does not include counterparties engaged in upstream activities, such as exploration and production. Also, the target-setting does not include oil and gas companies operating in the product marketing and retail sub-segment.

Emissions coverage

The indicator used for target-setting encompasses Scope 1 and 2 GHG emissions, excluding the emissions associated with the end use stage of oil and gas products (Scope 3 GHG emissions), which often constitute the majority of sectoral emissions. This exclusion is primarily due to lack of readily available and reliable data from clients, which introduces inaccuracies and uncertainties into the measurement and reporting processes. Oil and gas Scope 3 emissions are expected to be tackled through a dedicated sectoral target that focuses on the sector’s downstream value chain.

Decarbonisation scenario

By using the IEA NZE scenario as the reference transition pathway for the oil and gas sector, Eurobank aims to facilitate investments in technologies that will enable the sector’s transition, such as carbon capture and storage (CCS), methane reduction initiatives and the development of low-carbon fuels. The oil and gas sector represents a significant source of carbon emissions and is critical for global efforts to achieve net-zero emissions by 2050. Eurobank’s emission reduction target for the oil and gas sector focuses on promoting sustainable practices, reducing emissions, and supporting the transition to a more diversified and resilient energy system.

According to the Climate Law, facilities with significant environmental impact have an obligation to reduce their emissions by 30% by 2030 (reference year: 2019). The NECP does not include sectoral targets, but rather a general 9% reduction target for the entire industry by 2030 (reference year: 2020). Considering that the oil and gas sector is a hard-to-abate sector, with limited capacity in relation to process electrification, alternative solutions will have to be adopted (e.g. CCUS, green hydrogen). However, based on the current progress, their implementation timeline is post-2030.

Eurobank’s sectoral approach

Eurobank recognises the critical importance that the oil and gas sector has in the global transition to a sustainable and low-carbon energy system. Given the sector's substantial contribution to GHG emissions, particularly through the combustion of fossil fuels, decarbonising oil and gas operations throughout the entire value chain is essential for achieving global climate targets.

Eurobank’s current financed emissions in the oil and gas sector amount to 558 ktCO2e (indexed at 100% based on the sectoral methodology) as of the 2024 baseline year. The Group’s approach to target-setting considered the emission reduction effect, application feasibility and timing of the sector’s key decarbonisation levers. In addition, a key element in the process was the fact that clients in the Oil and Gas sector often have substantial and time-sensitive capital requirements, leading to significant fluctuations in financing activity. These fluctuations—driven by withdrawals or repayments—can materially affect exposure levels and, consequently, the attribution of financed emissions. As such, 2024 was selected as the base year because it more accurately reflects typical exposure levels across key clients, providing a sounder foundation for setting and tracking emission reduction targets.

Based on the above, it has set its target reduction target at -5% by 2030 in relation to its 2024 baseline. This target is based upon the emission reduction effect of more mature decarbonisation levers that are part of its key counterparties’ investment plans, which include energy efficiency measures (energy consumption optimisation, heat capture and integration, improved combustion efficiency, setup upgrades etc.) and the adoption / expansion of green hydrogen and biofuels, as these are expected to produce results by 2030.

However, key sectoral decarbonisation drivers, such as Carbon Capture and Storage (CCS) and process electrification, are not expected to be widely deployed by 2030 due to current market immaturity and regulatory constraints. As a result, these technologies have not been included in the Group’s 2030 target. Their limited near-term feasibility means that the majority of substantial emission reductions in the oil and gas sector are anticipated to occur post-2030, once these advanced technologies become commercially viable and supported by a more solid regulatory framework.

Accordingly, the Group expects for its post-2030 target to reflect the effect of these transformative solutions. This will enable a more accelerated decarbonisation trajectory, positioning the Group to adopt more ambitious goals that may potentially exceed the International Energy Agency’s Net Zero Emissions (IEA NZE) pathway.

To achieve this target, Eurobank will implement a multifaceted strategy, focusing on the sector’s priority areas. It will mobilise financing towards cleaner technologies, such as carbon capture, utilisation and storage (CCUS), and support the shift to low carbon energy sources, such as green hydrogen and biofuels. Additionally, it will invest in energy efficiency improvements, reduce methane emissions through advanced detection and capture technologies, and engage with clients and stakeholders to promote best practices and collaboration on sustainability initiatives across the oil and gas value chain. This approach ensures its financing activities support the broader transition to a low-carbon economy.

Iron and steel

Methodological approach

Boundary

The iron and steel sector is split into 3 segments:

- Upstream: Scrap pretreatment (e.g. shredding, sorting)

- Midstream: Electric arc furnace (EAF), Refining furnace, Casting

- Downstream: Reheating furnace, Hot rolling, Cold rolling, Cold drawing, Forming, Coating

For target setting in the sector it has included all counterparties that have operations in any of the above-mentioned segments.

Emissions coverage

The indicator covers Scope 1 and 2 GHG emissions, which are responsible for the vast majority of the Group’s iron and steel value chain footprint.

Decarbonisation scenario

Eurobank’s emission reduction targets for the iron and steel sector align with the trajectory outlined in the IEA Net Zero by 2050 scenario, focusing on reducing emissions intensity, increasing energy efficiency, and promoting the adoption of sustainable steelmaking practices. Eurobank is committed to supporting the transformation of the iron and steel sector towards sustainability, fostering innovation, and driving progress towards a carbon-neutral future.

Eurobank’s sectoral approach

The iron and steel sector plays a key role in the decarbonising industry and poses a great challenge due to its energy intensive nature and reliance on fossil fuels. To achieve meaningful emission reductions, numerous technologies, including green hydrogen, need to be applied at scale. Additionally, there should be a focus on using scrap steel, increasing energy efficiency, and electrifying the processes.

Eurobank’s current financed emissions intensity in the iron and steel sector stands at 0.37 tCO2e per tonne of steel as of 2023. In alignment with the IEA NZE scenario, Eurobank has set a target to reduce emissions intensity by 10% by 2030, bringing it down to 0.33 tCO2e per tonne of steel.

As of 2024, Eurobank’s financed emissions intensity has increased to 0.42 tCO2e per tonne of steel, representing a 14% rise compared to the 2023 baseline. This upward trend, while temporary, highlights the inherent volatility and complexity of decarbonising a sector that remains heavily reliant on fossil fuels and energy-intensive processes. Despite this short-term setback, Eurobank remains committed to its target and will continue to prioritise financing for innovative, low-emission technologies and work closely with clients to accelerate the transition to sustainable steel production.

Leveraging national and European strategies such as the European Green Deal Industrial Plan and the National Energy and Climate Plan, Eurobank will implement a comprehensive strategy that includes prioritising financing for projects incorporating innovative technologies and low-emission fuel consumption, such as green hydrogen, as well as electric arc furnaces powered by renewable energy. It will promote sustainable practices, such as adopting material efficiency and strategies to reduce losses, and optimise steel use. Furthermore, it will engage with clients and stakeholders to foster collaboration on sustainability initiatives, and encourage the sharing of best practices and innovative solutions.

Cement

Methodological approach

Boundary

The scope of this sector focuses on clients with activities related to the manufacture of cement and concrete products.

Emissions coverage

The indicator covers Scope 1 and 2 GHG emissions, which are responsible for the vast majority of Eurobank’s cement value chain footprint.

Decarbonisation scenario

Eurobank’s emission reduction targets for the cement sector are aligned with the goals outlined in the IEA NZE scenario, focusing on reducing emission intensity, promoting circular economy principles, and supporting innovation in sustainable cement manufacturing processes. By adopting the IEA NZE scenario as the transition pathway for the cement sector, it aims to incentivise investments in sustainable cement production methods, including the use of alternative fuels and raw materials, enhancing energy efficiency, and implementing carbon capture and utilisation technologies.

Eurobank’s sectoral approach

Concrete and cement are important for essential economic development; however, reducing sectoral emissions while producing sufficient cement to meet demand poses a great challenge. Reduction of the clinker-to-cement ratio through the uptake of clinker substitutes, continuous energy efficiency improvements, adoption of low-carbon fuels, material efficiency improvements, and deployment of innovative technologies, such as Carbon Capture and Storage (CCS), will play a significant role in achieving this goal.

Eurobank’s current financed emission intensity in the cement sector stands at 0.67 tCO2e per tonne of cement as of 2023. In alignment with the IEA Net Zero by 2050 scenario, Eurobank has set a target to reduce emissions intensity by 13% by 2030, bringing it down to 0.58 tCO2e per tonne of cement. This target has been developed by analysing the implementation maturity and emission reduction potential of the sectoral decarbonisation levers in conjunction with the investment plans of its key counterparties. The result was that the levers that are considered mature enough to result in emission reductions by 2030 included the procurement of carbon-free electricity through RES self-generation, PPAs and Guarantees of Origin, energy efficiency measures, such as strategic maintenance practices and fuel selection, process optimisation, diagnostic tools and application of mineralisers, reducing the clinker-to-cement ratio and the use of alternative fuels.

However, the key decarbonisation levers for the sector, which include the adoption of green hydrogen and Carbon Capture technologies, are not considered mature enough to be able to yield results by 2030, due to market immaturity and regulatory constraints. Thus, as advancements in technology and policy will remove these barriers, Eurobank anticipates that these technologies will become viable and scalable in the post-2030 period. As a result, the Group’s targets will become more ambitious beyond 2030, potentially exceeding the IEA Net Zero by 2050 pathway, as the full suite of decarbonisation solutions becomes available and economically feasible.

Eurobank’s 2024 sectoral progress demonstrates a marginal decrease in emission intensity, from 0.67 tCO2e per tonne of cement in 2023 to 0.66 tCO2e. This early progress, though modest, reflects the initial impact of mature decarbonisation efforts taking effect. These developments signal positive momentum toward its 2030 target and reinforce the importance of sustained investment and engagement with counterparties to accelerate the sector’s transition.

Eurobank will focus on financing investments that will decrease process emissions from clinker production, which accounts for most of the sector’s emissions, and reduce its reliance to fossil fuels for its high-temperature production process by promoting the expansion of green hydrogen and other low carbon fuels. It will support its clients’ efforts to optimise their production processes to lower energy consumption, while also financing the deployment of innovative technologies, such as Carbon Capture and Storage (CCS), which will play a significant role in achieving the decarbonisation of the sector. Furthermore, Eurobank will engage with clients and stakeholders to foster collaboration on sustainability initiatives, encouraging the adoption of best practices and innovative solutions.

Biodiversity

Eurobank seeks to ensure accountability and transparency in its biodiversity strategy, aligning its operations with global sustainability standards and contributing to the preservation of natural resources for future generations. Based on the financial sector's capability to influence the sustainable use of nature through its business activities, Eurobank is already taking appropriate steps to integrate biodiversity loss into its operations, by developing a corresponding response strategy and incorporating relevant provisions in the risk management framework. These actions have been embedded into the Group’s operating model to ensure that the Group has established ongoing actions:

- Activities that violate local laws or international conventions on biodiversity or cultural heritage are not financed by the Group.

- The ESG Questionnaire, which is used by the Group, assesses borrowers' biodiversity loss risk.

- A qualitative Risk Appetite Statement (RAS) has been introduced concerning the environmental risk posed to biodiversity. Based on its exclusion list, the Group refrains from financing activities prohibited by host country legislation or international conventions relating to the protection of biodiversity resources.

Eurobank’s strategic action plan around biodiversity will evolve around the following elements:

- Risk assessment – Integrate comprehensive transaction assessments to identify and understand biodiversity risks and dependencies using tools such as ENCORE.

- Sector analysis – Focus on high and medium-risk sectors, such as agriculture, forestry, water supply, mining and energy, and promote measures and financing that mitigates biodiversity impacts.

- Sustainable finance – Promote and finance activities and projects that support biodiversity conservation, rehabilitation of ecosystems and sustainable use of natural resources.

Considering the complexity of assessing the issue of biodiversity as a risk driver in relation to Eurobank’s business practices and own operations, given the fact that the relevant guidance in this field is currently under development, Eurobank is closely following several related initiatives and continues to build its skills and capacity, so as to ensure readiness to appropriately address such risks, upon the availability of more granular guidelines and methodologies in this respect.

According to Eurobank Asset Management MFMC's Responsible Investment Policy, sustainability factors are integrated into the investment process. This includes assessing environmental criteria such as greenhouse gas emissions, fossil fuel exposure and water emissions. Negative impacts on fund returns may arise from aspects such as carbon emissions, water pollution, biodiversity loss or ecosystem damage. The sustainability factors considered vary based on the specific investment strategy of each fund or portfolio.

Sustainable financing under the RRF

Eurobank managed to stand out among its peers in deploying RRF funds in the Greek economy, through strong commitment towards the recovery from the pandemic, and a more sustainable, environmentally friendly and socially just direction. The Bank’s business strategy regarding the RRF-related loans has been set to effectively achieve the main objectives of the RRF programme, such as including diversified projects from all company sizes, distributed across all eligible pillars, while focusing on meeting certain performance thresholds regarding green transitioning and digital transformation in RRF-financed projects. The approved investments fall mainly under the Green Transition pillar, followed by the Digital Transformation and Extroversion pillars, channelling the RRF funds into a large number of enterprises from different sectors, such as:

- Renewable energy sources (RES) for the construction of PV parks

- Electromobility and micromobility

- Telecommunications and fibre optic network upgrades

- Retail

- Production of batteries and energy storage solutions

- Tourism

- Pharmaceutical industry

- Food and beverage industry

- Provision of electronic services

With its exemplary performance and fast RRF fund absorption rate, Eurobank has proved its ability to effectively use the available EU financial instruments and manage complex financial operations, targeting economic growth. Throughout 2024, the Bank successfully signed 17 transactions, contributing to a cumulative total of 85 transactions since the inception of the RRF programme. The 85 transactions, which include both bilateral and syndicated agreements, facilitated investments amounting to €6.8 billion, out of which €1.76 billion were mobilised through the RRF funds. Some representative transactions Eurobank carried out in 2024 under the Greece 2.0 National Recovery and Resilience Plan include:

- Eurobank acted as Arranger and Underwriter for an €810 million syndicated bond loan granted to DESFA. The purpose of the loan is to finance general business purposes, capital requirements, capex acquisitions, working capital needs, eligible under the RRF expenses for the construction of pipelines and stations technically ready to accept and transport hydrogen, as well as digital transformations for the upgrade and transformation of the company.

- Eurobank acted as Agent and Underwriter for a €120 million common bond loan granted to Autohellas. The purpose of the loan is to finance the Company's investment plan for expanding its fleet through the purchase of new zero-emission electric vehicles.

- Eurobank acted as Mandated Lead Arranger, Underwriter and Hedging Counterparty for a €204 million syndicated bond loan granted to AMYNTEO SOLAR PARK NINE SMSA, a subsidiary of METON ENERGY SA (a joint venture of RWE Renewables Europe & Australia and PPC Renewables). The loan agreement concerns the construction of the “Orycheio Dei Amynteo” photovoltaic park (Cluster III), with a total installed capacity of approximately 450 MWp.

Products and services with positive social and environmental impact

Eurobank has developed a number of banking products aimed at supporting specific social issues or having a positive environmental impact. This range of products underlines the Bank’s commitment to promoting best practices, addressing pressing social issues and fostering long-term sustainability.

Green mortgage loans

Eurobank has consistently supported energy-saving initiatives and the energy upgrade of private residences in Greece through active participation in national programmes such as Exoikonomo. In 2024, the Bank continued to solidify its presence through participation in Exoikonomo 2021 and Exoikonomo 2023, funded by the Recovery and Resilience Facility (RRF) under the NextGenerationEU initiative. Eurobank facilitates participation through simplified processes, financing tools for contractors and additional benefits for clients selecting its loan products.

The Bank contributed to the programmes’ design through its involvement in the Hellenic Bank Association and developed the required digital infrastructure to support loan applications. In 2024, Eurobank continued loan disbursements under these programmes, offering a digital and expedited application process, along with additional benefits, such as a welcome gift through the €pistrofi loyalty programme and reduced insurance premiums in cooperation with Eurolife FFH.

Additionally, Eurobank offers the Green Mortgage Loan – Saving Energy for customers not eligible under the Exoikonomo schemes, supporting investments in energy-efficient upgrades, such as photovoltaic systems, heating and air-conditioning replacements, and insulation improvements.

Photovoltaic RBB loans

Eurobank supports small businesses through the financing of photovoltaic systems, offering them the opportunity to carry out their investment plans for energy production and sale from renewable energy sources (RES). Customers can choose between loan or leasing options, financing up to 80% of the total budget for loans and up to 100% of equipment costs for leasing. In 2024, new disbursements for photovoltaic RBB loans amounted to €13.4 million.

ESG product pipeline

As part of its strategy to increase the penetration of ESG products, Eurobank has a pipeline of products aligned with the Sustainable Finance Framework, directed towards small businesses and individuals, focusing among others on promoting RES technologies and energy upgrades for infrastructure and equipment. The Bank's ultimate goal is to actively contribute to meeting national environmental targets and protecting the environment through dedicated green banking products that offer cost-efficient financing solutions to cover all potential green needs of citizens.

“Everyday allies in remote border areas” payroll/pension programme

Eurobank has launched a new initiative aimed at supporting populations in remote areas and addressing demographic challenges. Recognising the critical role of the Greek armed forces and security services, the Bank has introduced the "Everyday allies in remote areas" payroll/pension benefit programme. This exclusive programme targets both active and retired personnel, enhancing their buying power for daily expenses by offering to more than 2,500 customers a higher percentage in the €pistrofi loyalty programme when they shop in these regions. Eurobank's strategic focus on tackling demographic issues and its ongoing commitment to supporting customers through tailored initiatives underscore its dedication to reinforcing the mutual trust that has been built over time.

Mortgage loan for large families in remote border areas

As part of its commitment to social responsibility and to support vulnerable population groups, Eurobank launched a new mortgage loan for main residence with 1% fixed interest rate for the entire loan term to families that have at least 3 children and live permanently in the Greek border areas targeted by the Moving Family Forward initiative. Through this initiative, the Bank promotes equal access to housing and the development of populations in regions with distinct needs, contributing to regional sustainability.

Student loans

Eurobank has multiple initiatives both at business and CSR level, focusing on widescale support of youth education. In this context, Eurobank offers a student loan tailored to financing undergraduate or postgraduate studies, covering tuition fees, initial relocation expenses and other student needs. The student loan comes with favourable interest rate – compared to standard personal loans – and, to make it more affordable, Eurobank offers flexible repayment terms and the option of student family members acting as loan guarantors.

WWF Eurobank Visa – First green banking product in Greece celebrates 25 years

Eurobank has been offering the WWF Eurobank Visa, the first green banking product in Greece, since 2000. This product is a result of the long-standing partnership between Eurobank and WWF Hellas. By the end of 2024, WWF Hellas had received €1.95 million through the WWF Eurobank Visa, benefiting 16,448 active cardholders without any additional cost to them.

Some of the key actions supported by Eurobank include:

- Oikoskopio online app – Providing maintenance and technical support for both the Greek and English versions, enriching it with new information, and adding games to the kid’s section.

- Dadia National Park – Protecting valuable natural habitats, especially for internationally threatened birds of prey. Following the 2023 wildfires, the Bank supported actions, jointly implemented by WWF Greece and the Society for the Protection of Biodiversity in Thrace, to constantly monitor the burnt sites, and to design and implement interventions and initiatives to revive the forest and protect the threatened species it hosts.

- Environmental policy support – Financing actions to support WWF's work on environmental policy issues, such as creating maps illustrating forest fire problems, recording lignite power stations and highlighting the ecological value of coastal areas.

- Sekania Beach on Zakynthos – Protecting the loggerhead sea turtle (Caretta caretta) by increasing security, implementing fire-prevention projects and more.

- Environmental legislation and governance – Supporting the agency's actions, including evaluating and commenting on legislation, formulating legal proposals, and participating in EU-level advocacy actions.

These initiatives reflect Eurobank's commitment to environmental protection and sustainable development

Eurobank, Greek partner of the Priceless Planet Coalition

Eurobank is the exclusive Greek partner of the Priceless Planet Coalition, an innovative environmental initiative recognising the private sector's role in addressing climate change. Aligned with the UN Sustainable Development Goals and the Principles for Responsible Banking, and in collaboration with Conservation International and the World Resources Institute, the Priceless Planet Coalition is an initiative to help restore 100 million trees by uniting the efforts of financial institutions, merchants, communities and consumers globally. In 2024, Eurobank contributed USD $123,048 (€120,000) to support this initiative.

Biodegradable debit cards

Eurobank is the first bank in Greece to offer biodegradable debit cards, showcasing its commitment to environmentally friendly initiatives. Since 2019, all newly issued or renewed debit cards for individuals and businesses are made of 82% polylactic acid (PLA), a biodegradable, petroleum-free and non-toxic plastic substitute. This material requires less energy to produce and emits fewer greenhouse gases compared to traditional PVC, which is not biodegradable and releases toxic gases when burned. As of 2024, approximately 2.7 million biodegradable debit cards have been issued, with plans to replace the entire debit card stock by the following year.

PNOE – Friends of Children in Intensive Care

Eurobank has supported PNOE – Friends of Children in Intensive Care for 24 years, helping create and equip paediatric intensive care units. Since 2000, Eurobank's EuroLine card contributes 0.20% of transaction values at Eurobank POS terminals to PNOE. In 2024, about 19,557 active EuroLine cards generated a donation of €26,868.31.

Fashion Targets Breast Cancer Campaign

Eurobank's collaboration with the Fashion Targets Breast Cancer campaign started in 2004 with the introduction of the EuroLine Style Mastercard, which was aimed at women. Over the past 21 years, Eurobank has supported the campaign in Greece, focusing on informing women about breast cancer prevention and early diagnosis. In 2024, there were approximately 27,356 active EuroLine Style credit cards. Eurobank donates 0.15% of the card's annual turnover to Target-Prevention, the Greek Society for Cancer Prevention. In 2024, this donation amounted to €26,560.70, which was used to support the association's initiatives to educate and train women on breast cancer prevention.

Sustainable finance at international subsidiaries

| Sustainable financing | |

|---|---|

| Bulgaria | |

|

Actions:

Performance:

Targets:

|

|

| Cyprus | |

| Hellenic Bank | Eurobank Cyprus |

|

Actions:

Performance:

Targets*:

|

Actions:

Targets*:

|

| Luxembourg | |

|

Actions:

|

|

Financial inclusion

Eurobank promotes financial inclusion by supporting small businesses and social finance, enabling accessible banking services, and extending inclusive practices across its international subsidiaries.Supporting small businesses and social finance

Eurobank promotes financial products specific to infrastructure and supported services, with the aim of helping businesses grow and become updated, enhance their competitiveness, and improve the quality of the products and services they offer.

Financing SMEs through AFI

At the beginning of 2024, the Bank granted a €5 million credit line limit to AFI in order for the latter to finance vulnerable social groups when establishing or expanding micro-enterprises.

Eurobank Development initiative

The actions of the Partnership Agreement (PA) for the 2021- 2027 Development Framework, mainly aim to boost the competitiveness and extroversion of businesses, focusing on innovation and on increasing domestic added value.

Eurobank has developed a comprehensive range of information services for SMEs, enabling them to take advantage of the PA programmes.

Business advisors provide information about the co-funded programmes available to each business area/industry, while a dedicated phone line is also available for additional information or questions. Eurobank has come to several agreements with specific providers of eligible services within the ecosystem framework, to enable SMEs to find suitable partners for their investment.

An integrated programme has also been designed, which includes financing to cover both the private participation financing and the grant of “pre-financing”, ensuring adequate capital throughout every stage of the investment, so it may be concluded within the estimated time.

Collaboration with the Hellenic Development Bank (HDB/EAT) & European Investment Fund (EIF)

Aiming to support the economy successfully, Eurobank makes the most of every favourable measure to facilitate access to financing for Greek enterprises. Specifically, in collaboration with the Hellenic Development Bank (HDB), during 2024, the disbursements were €144 million through TEPIX III Guarantee Fund and €26 million through TEPIX III Loans Fund.

Eurobank also participates in the "Business Growth Fund” and "Tamio Eggiodosias Kenotomias" programmes.

In addition to that, in collaboration with EIF disbursed 250 million through the “ΙnvestEU SME Competitiveness” and €200 million through the “InvestEU RRF SME Competitiveness” financial financing programmes.

For further information on supporting small businesses and social finance programmes refer to the Sustainability Statement.Making banking accessible

Eurobank is committed to making its services accessible to all, focusing on customer service and inclusivity. The Bank provides banking access to remote areas through Hellenic Post branches in 238 municipal communities with populations of fewer than 5,000 people, many of whom have difficulty in physically accessing services on islands, such as Agathonisi, Anafi etc. Additionally, 242 areas have access though offsite ATMs, such as on Agios Efstratios, Alonissos and Symi.

The Bank's phygital approach combines physical service with technology to enhance customer relationships. Eurobank's initiatives are adapted across subsidiaries in Bulgaria, Cyprus and Luxembourg, ensuring accessibility and inclusivity.

In 2024, Eurobank improved customer service by scheduling over 1,114,000 appointments, increasing the time relationship managers allocate to each client, and launching the Mobility Project for offsite banking. The Digital Safe Box allows customers to get complex products remotely.

Eurobank received several awards in 2024 for its efforts in diversity, equity and inclusion, as well as for its innovative practices in customer service and digital transformation. The Bank's human-centric phygital model combines technological infrastructure with the human factor to provide simple, fast and personalised services.

The following metrics and actions demonstrate Eurobank’s efforts to serve people with disabilities:

Physical accessibility

- ATMs: 100% of ATMs feature voice guidance, 117 ATM (10%) are wheelchair accessible.

- Branch accessibility: 92 branches with ramps, 7 branches with detachable ramps. Eurobank creates sensory relief spaces in branches for individuals on the autism spectrum. Moreover, it offers services to its customers services in English at branches and through other banking channels.

Priority service

- Branch and EuroPhone Banking: Priority service for customers with disabilities, with QR codes or dissability digital card and disability keywords routed to trained agents.

Document and communication accessibility

- Assistive tech: Transaction documents in formats compatible with assistive technologies.

- Braille: Documents available in Braille.

Digital accessibility services:

- v-Banking: Sign language – trained staff assist deaf and hard of hearing customers through video.

- Eurobank Mobile App and e-Banking: Ensure digital accessibility through continuous audits and improvements based on WCAG level AA standards. Adjustments include font sizes, colours, contrast ratios, keyboard navigation, and properly structured code for assistive technologies. The content structure is designed to facilitate easy navigation for users with assistive technologies.

- Digital Safe Box: A digital tool for remote product acquisition (i.e. cards, loans and insurance products), allowing customers to sign documents online. It accounts for approximately 20% of product sales (considering the products available in the Digital Safe Box), with plans to expand product offerings.

Staff training

- Employee programmes: 1,827 employees trained on disability awareness and inclusivity (online programmes and experiential training).

Apart from the digital channels, Eurobank provides products and services to customers through the channels listed below.

Branch network

At the end of 2024, the Eurobank branch network numbered 266 branches. The Bank’s branches are entering a new era in banking services, combining advanced digital options with personal support provided by its staff.

In 2024, Eurobank focused on enhancing customer service and productivity through:

- Appointment scheduling: Over 1.1 million appointments were scheduled with 32% of total appointments booked through the online platform available since July 2023.

- Improved client relationship management:

- The call centre now handles calls for all branches, to ensure faster service.

- Between 10:00-13:00 branch staff focus on advisory services, with monetary transactions handled through self-service terminals. This has been implemented in 264 out of 266 branches. For the summer season, the operating hours of Meta Teller are extended for the purpose of providing excellent service to RBB clients. Specifically, the service hours are extended by 1 hour (08:00-10:00 and 12:00-14:00).

- Mobility Project: 1,400 officers gained offsite access to provide end-to-end banking services during customer visits.

ELTA network

The Bank has an exclusive cooperation agreement with Hellenic Post (ELTA), allowing its customers to access core banking services through the ELTA network.

With 469 post-office branches and 116 ATMs across Greece, the Hellenic Post network offers extensive nationwide service, including remote areas with limited or no banking presence.

External networks

In 2024, the external sales networks maintained their momentum, despite fierce competition. This Unit’s primary goal is to develop B2B cooperations with third legal entities, with the aim of increasing loan origination in the following segments:

- Retail Business Banking external sales – The Bank expanded its business through agreements in new markets, such as business consultants and PV installers, and through new collaborations with professional equipment dealers. Disbursements reached €22 million, up by 21% year-on-year.

- Mortgage loans through associates – Despite the new market conditions, disbursements reached €83 million, contributing significantly (23%) to the Bank’s total disbursements. Eurobank also managed to maintain its market share in green mortgage loans to 21% through the last Exoikonomo 2021 programme.